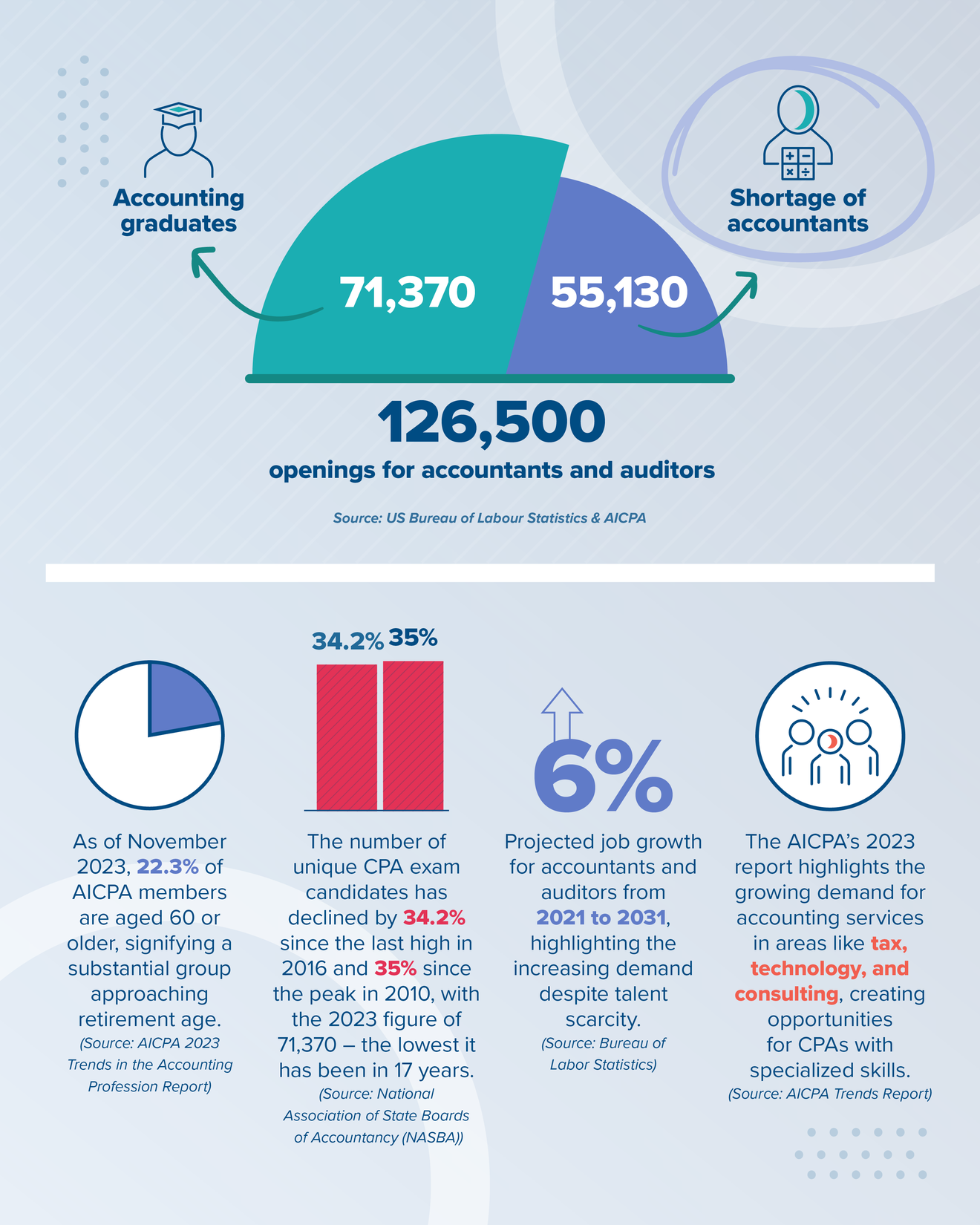

The talent shortage that has plagued the industry for several years is set to continue into 2024.

As fewer graduates enter the market each year, and retirees leave the industry entirely, the talent pool of available resources with general – and specialist – skills is steadily decreasing.

The talent crunch: reasons for the decline in talent numbers

While these two key areas are core to the reduced numbers of talent available – impacting firms of all sizes globally – additional reasons behind the talent crunch in Accounting and Audit include:

-

Declining interest in the profession as younger generations choose alternative high-growth career paths, shifting from the demands of longer hours and peak working schedules during busy seasons.

-

Evolving skillsets and the rapid evolution of the way we work – including the introduction of new technologies, such as AI, and data analytics – mean that professionals in this industry can no longer be specialists; they need to broaden their skillsets beyond traditional accounting and audit knowledge.

-

Increasing complexity of audit and accounting tasks, together with increased workloads and new/changing regulations, makes it challenging for firms to find candidates who can handle the demands of the job.

-

Large numbers of the audit and accounting workforce are nearing retirement age – leaving a gap in the talent pool as experienced professionals exit the workforce.

Impact areas of the global talent shortage

While this has, previously, had very little impact on most firms, we are seeing an increase in the following areas:

-

Increased competition for talent – particularly candidates with diverse skills.

-

Competition increases demand, and subsequently drives up salaries, making it difficult for firms to attract and retain talent.

-

This gap in retention leads to quality concerns – with firms pressurized to fill positions quickly and hiring less qualified candidates, raising concerns about the quality of audit and accounting services.

-

When candidates are not available, existing employees face increased workloads and pressures – leading to burnout and decreased productivity.

Talent augmentation strategies and trends to support firms with talent shortages

In the face of this changing landscape, talent augmentation emerges as a strategic solution to address the pressing issue of talent shortage faced by various industries, particularly accounting firms. This approach not only bridges the skill gap by providing access to specialized expertise but also proves to be a cost-effective alternative to traditional full-time hiring. The flexibility offered by talent augmentation allows firms to scale their talent pool according to fluctuating workloads and project demands, presenting a dynamic solution to the challenges posed by evolving industry trends.

As firms increasingly partner with augmentation partners, there are several key trends in 2024 for this approach:

Advisory services are in demand, and clients want more than just basic compliance from their accountants. They want – and need – strategic advice on everything from business growth to tax optimization. This trend means that accounting talent that has this strong analytical background with keen business acumen will be in demand – a combination that is difficult to source, even in times where talent was readily available. Talent augmentation partners have a wide range of skilled talent available and can accommodate very particular and niche skillset requirements quickly and efficiently.

Advisory services are in demand, and clients want more than just basic compliance from their accountants. They want – and need – strategic advice on everything from business growth to tax optimization. This trend means that accounting talent that has this strong analytical background with keen business acumen will be in demand – a combination that is difficult to source, even in times where talent was readily available. Talent augmentation partners have a wide range of skilled talent available and can accommodate very particular and niche skillset requirements quickly and efficiently.

The adoption of technology and automation – including robotic process automation (RPA) and AI – will be pivotal in freeing up accountants to focus on higher-value work. Roles and requirements are constantly changing, and firms can bolster teams with specialized expertise in new technologies when accessing a pool of global resources with these skills.

The adoption of technology and automation – including robotic process automation (RPA) and AI – will be pivotal in freeing up accountants to focus on higher-value work. Roles and requirements are constantly changing, and firms can bolster teams with specialized expertise in new technologies when accessing a pool of global resources with these skills.

Increasing cyber threats and stricter data privacy regulations mean that firms need robust security measures and data governance practices to keep themselves – and their clients’ – data secure, highlighting the importance of specialized cybersecurity professionals. Firms can also acquire this niche skillset from talent augmentation partners – avoiding the need to upskill staff or find additional resources in a limited talent pool.

Increasing cyber threats and stricter data privacy regulations mean that firms need robust security measures and data governance practices to keep themselves – and their clients’ – data secure, highlighting the importance of specialized cybersecurity professionals. Firms can also acquire this niche skillset from talent augmentation partners – avoiding the need to upskill staff or find additional resources in a limited talent pool.

The ability to offer remote and flexible work options is becoming increasingly important in attracting and retaining talent. This approach allows firms to tap into a global pool of talent, regardless of location, expanding their hiring options and improving diversity and inclusion.

The ability to offer remote and flexible work options is becoming increasingly important in attracting and retaining talent. This approach allows firms to tap into a global pool of talent, regardless of location, expanding their hiring options and improving diversity and inclusion.

Leverage talent augmentation solutions with trusted partners

In response to the ongoing challenges, talent augmentation remains a dynamic and cost-effective solution, offering firms the flexibility to scale their talent pool and address specific skill gaps. Looking ahead, key trends in talent augmentation reveal the growing demand for analytical expertise, the pivotal role of technology and automation, the need for specialized cybersecurity professionals, and the rising importance of remote and flexible work options. Embracing these trends and partnering with talent augmentation providers will position firms to not only overcome the current talent crunch but also thrive in an ever-evolving industry landscape.

In 2023, accounting firms in the United States faced challenges such as the rapid expansion of generative AI tools, a growing talent shortage, and the need to control costs amidst persistent inflation and rising interest rates.

Embracing Change and Technology

As 2024 approaches, the industry anticipates a year of change management, with a focus on adopting technology for increased revenue and profitability. A survey revealed key challenges, including staff shortages, inefficient processes, and overwhelming client work. To address these issues, firm owners must efficiently operate and leverage technology. Despite high interest in AI, there is a gap between interest and action, with only 25% actively investing in AI training.

Emerging Trends: Monetization, Talent Acquisition, and AI Integration

Two prominent trends emerge: first, accounting firms must monetize scope creep and manage client expectations to turn requests into revenue opportunities. Second, firms need to find and retain talent through non-traditional approaches, considering outsourcing and competitive salaries. The third trend emphasizes the transformative impact of AI on the industry, urging firms to embrace automation for improved performance, insights, and work-life balance. In 2024, firms should invest in training to capitalize on these tools and redefine hiring practices to include IT and tech specialists.

-

The 2023 Top 100 Most Influential People in Accounting – https://www.accountingtoday.com/list/the-2023-top-100-most-influential-people-in-accounting

-

The 2023 Top 100 People: The biggest issues in accounting – https://www.accountingtoday.com/list/the-2023-top-100-people-the-biggest-issues-in-accounting

-

How AI transformed the tax and accounting profession in 2023 – https://tax.thomsonreuters.com/blog/how-ai-transformed-the-tax-and-accounting-profession-in-2023/